Own Nothing.

Control Everything.

I built my family's wealth fortress using Liechtenstein foundations.

Let me show you how the structure works.

Independent wealth structuring for Swiss residents with CHF 2-5M+ in assets. No products to sell. No hidden commissions. Just the blueprint I used for my own family.

Is This Right For You?

Liechtenstein Family Foundations are not for everyone.

This structure makes sense if you have:

CHF 1-5M+ in Assets

Real estate, portfolios, business holdings, or alternative wealth

✓

Multi-Generational

Thinking not just your retirement—your children's children

✓

Willingness to Transfer Irrevocably

True protection requires true separation

✓

Comfort with Sophisticated Structures

This isn't DIY—it requires professional coordination

✓

If this describes you, keep reading.

If not, this structure may be premature.

Not sure if you qualify? Let's discuss.

The Paradox of Ownership

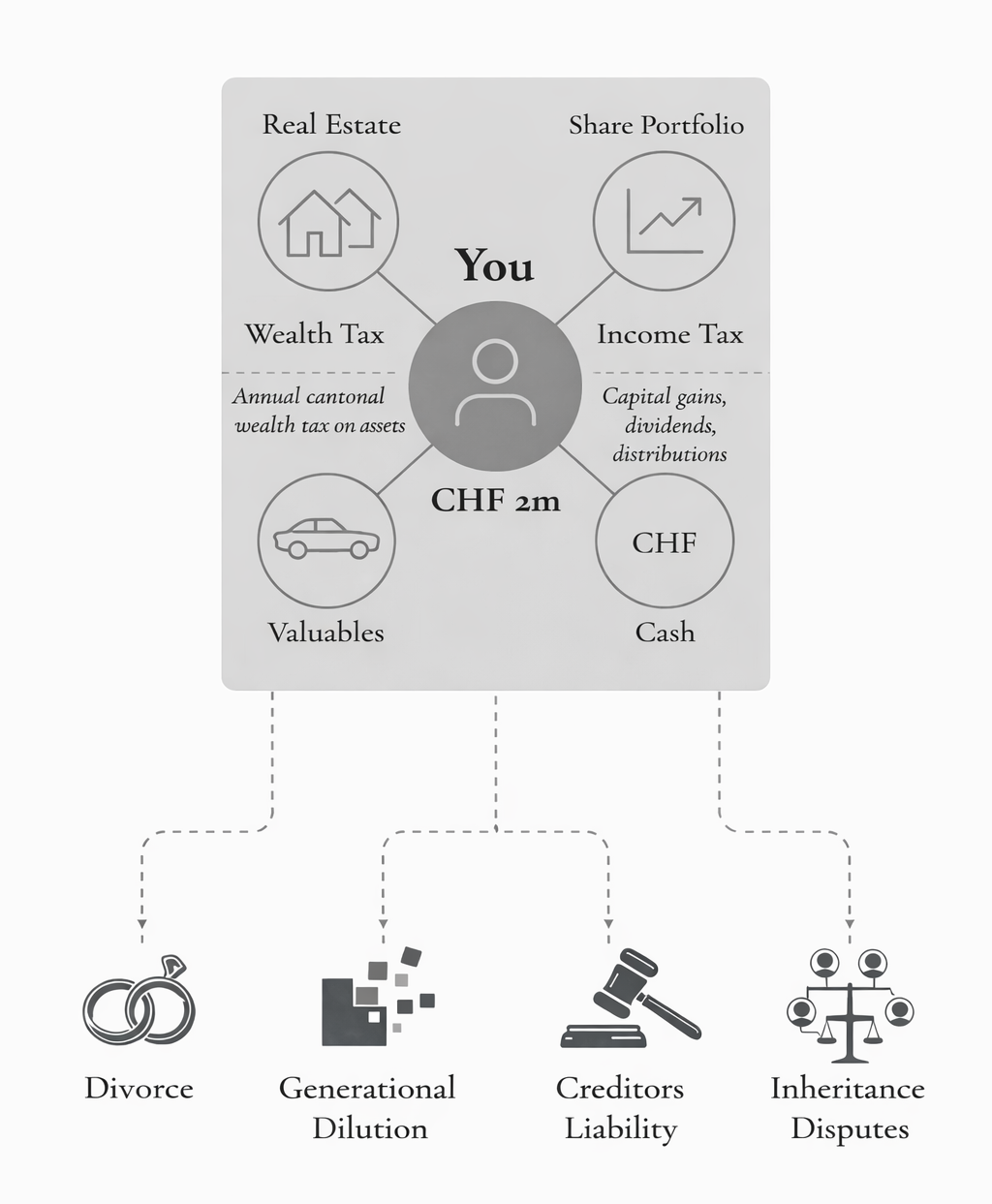

You've built significant wealth—CHF 2M+ across real estate, portfolios, and other holdings.

But direct ownership, the very symbol of success, creates exposure:

Cantonal wealth tax eroding your portfolio annually

Creditor claims from business or professional liability

Divorce settlements threatening family assets

Forced heirship diluting generational wealth

Inheritance disputes and probate delays

Public records revealing your financial position

The question isn't whether these risks exist. It's whether your current structure can withstand them.

The Liechtenstein Foundation Structure

A Liechtenstein Family Foundation transforms the equation:

Assets are legally separated from your personal estate, yet you maintain control through strategic architecture.

Layer 1:

Foundation

Legal owner of assets

No shareholders (owns itself)

Governed by council you appoint

Layer 2:

PPLI Wrapper

Insurance company as holder

Bankruptcy privilege protection

Investment freedom maintained

Layer 3:

PAS Tax Status

Foundation = separate entity

CHF 1,800 flat tax (Liecht.)

No wealth tax on assets (Swiss)

Result:

Assets legally separated.

Control maintained.

Multi-generational protection.

-

A Liechtenstein Family Foundation is a legally independent entity with no shareholders—it owns itself. You establish it through a Foundation Deed that defines the purpose, names beneficiaries, and sets binding rules for governance and distributions. The Foundation Council (at least 2 members, including a qualified Liechtenstein trustee) manages the assets according to your instructions. You can be a council member yourself and can reserve the right to appoint and remove other members. This is not a discretionary trust—you set the rules, and the council must follow them. The foundation is registered in Liechtenstein but can hold assets worldwide, including Swiss real estate, international portfolios, and business holdings.

-

Private Placement Life Insurance (PPLI) serves as a sophisticated legal wrapper around your investments—think of it as a protective container, not traditional life insurance. Governed by Liechtenstein's Insurance Supervision Act, PPLI provides four strategic advantages: (1) Freedom of Investment—you select specific assets like equities, private equity, or alternative investments; (2) Strict Insurance Secrecy—violations are punishable by imprisonment or CHF 360,000 fine (Art. 44 ISA); (3) Premium in Kind (Sacheinlage)—you can contribute existing assets like gold, real estate, or securities directly without selling; (4) Simplified Reporting—the insurance company becomes the beneficial owner on balance sheets, streamlining CRS/FATCA compliance. Minimum initial capital: CHF 500,000-1,000,000. Annual fees typically 0.5-1% of policy value.

-

Private Asset Structure (PAS) status is the key to tax efficiency for Swiss residents. When properly structured as a "non-transparent" foundation, Swiss tax authorities recognize the foundation as a separate legal entity—not as your personal asset. This means: (1) Foundation assets are removed from your personal wealth tax declaration; (2) Foundation investment income and capital gains are not attributed to you for Swiss tax purposes; (3) You're only liable for income tax on distributions you actually choose to receive; (4) The initial asset transfer may be a one-time taxable gift, but it removes assets from your estate for future inheritance tax. At the foundation level in Liechtenstein: CHF 1,800 minimum annual tax (no regular income tax), dividend income and capital gains from shares are tax-exempt, and no withholding tax on distributions to beneficiaries. Critical: PAS status depends on true irrevocability—if you retain excessive control (like right of revocation), authorities will "see through" the structure and tax you as if it doesn't exist.

You Are The Conductor, Not Just An Owner

Relinquishing ownership doesn't mean surrendering control.

Foundation Deed

Your binding rules

You define purpose, beneficiaries, and distribution rules.

Legally binding.

Foundation Council

The management body

At least 2 members, including qualified Liechtenstein trustee.

You can be a member.

You can appoint/remove.

Letter of Wishes

Your guidance for discretionary matters

Non-binding but influential direction for the council.

Adds personal touch to formal structure.

The council must perform your composition.

That's Liechtenstein law.

Why Trust Me With Your Family's Legacy?

I've Walked This Path.

Stephan Graf

Graf Wealth Advisory

Over 20 years in institutional asset management, working with

sophisticated investors at LGT Capital Partners and Man Investments.

But credentials aren't why you should trust me.

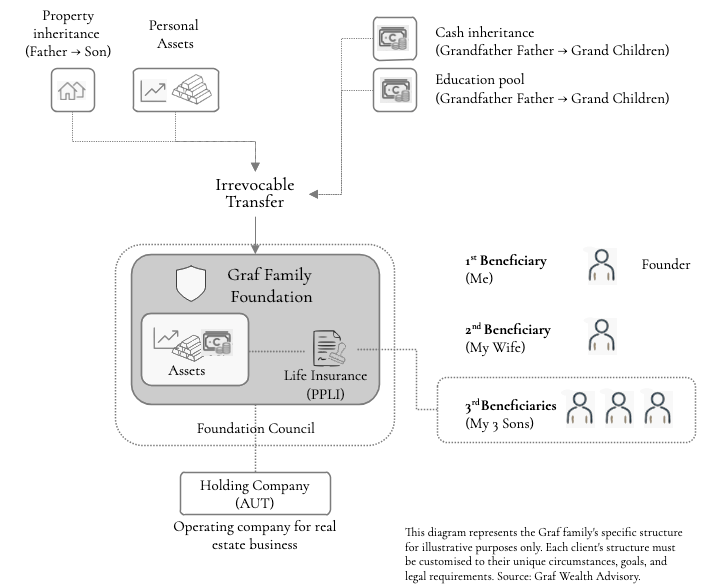

You should trust me because in 2021, I established the Graf Family Foundation to protect my own family's wealth.

Not as a marketing exercise. As a genuine multi-generational structure for my wife and three sons.

Every strategy I recommend to clients, I use myself.

Graf Family Foundation (Liechtenstein)

This is the real structure—not a hypothetical case study.

Has it been perfect? No.

Setup required three months of intensive structuring work. Annual maintenance costs more than I initially projected. Irrevocability means I can't just "undo" it if I change my mind.

But would I do it again? Without hesitation.

The peace of mind knowing my family's wealth is protected—not just for my lifetime, but for my grandchildren's—is worth every franc and every complexity.

That's the structure I can help you build.

A Transparent View:

What This Structure Cannot Do

Sophisticated wealth structuring requires honesty about limitations.

Here's what you need to know:

Cannot Eliminate Existing Obligations

Pre-existing debts, divorce settlements, or tax liabilities remain.

Structures must be established before claims arise.

✗

Cannot Circumvent Forced Heirship Entirely

Liechtenstein law is more flexible than Swiss, but constraints exist. Professional legal counsel required to navigate properly.

✗

Requires True Irrevocability

If you retain right to revoke, Swiss authorities will see through it. PAS status depends on genuine separation.

✗

Substantial Cost Commitment Required

CHF 40-80k setup, CHF 15-30k+ annually. Only makes sense for serious, long-term wealth preservation.

✗

Complexity Demands Professional Maintenance

Annual reporting, compliance monitoring, strategic review. This isn't "set and forget"—it requires ongoing governance.

✗

Regulatory Environment Can Evolve

Laws change. Structures require periodic review and potential adjustment. Requires commitment to professional relationship, not one-time transaction.

✗

These limitations aren't flaws—they're the foundation's protective power.

Structures that promise everything deliver nothing.

This structure cannot guarantee protection from all claims or obligations. Suitability depends entirely on individual circumstances and proper structuring. Independent legal and tax advice required.

An Investment in Perpetual Security

Let's be direct about cost.

For families with CHF 2-5M+ thinking multi-generationally, Liechtenstein foundations represent the most powerful wealth protection vehicle in European law.

But they require substantial investment—both initially and ongoing.

Here's exactly what you're investing in:

One-Time Establishment

Liechtenstein Registration

CHF 1,000 – 3,000

Legal Documentation

CHF 5,000 – 15,000+

Notarial Services

CHF 1,500 – 3,000

Initial Trustee Setup

CHF 3,000 – 8,000

PPLI Setup

CHF 2,000 – 5,000

Advisory & Coordination

CHF 10,000 – 20,000

Total Estimated Setup:

CHF 40,000 – 80,000

Annual Ongoing Governance

Liechtenstein Tax (PAS status)

CHF 1,800 (flat fee)

Foundation Council & Trustee

CHF 5,000 – 10,000+

PPLI Administration

0.5-1% of assets annually

Accounting & Compliance

CHF 2,000 – 5,000

Ongoing Strategic Advisory

[Separate fee schedule]

Total Estimated Annual:

CHF 15,000 – 30,000+

My Compensation:

You Choose

Fee-Only Model

(Independent Advisory)

You pay me directly.

I receive no commissions from service providers

Pure independence

Higher upfront investment

Best For:

Clients who value absolute independence and want zero conflicts of interest

Commission-Based Model

(Lower Initial Outlay)

Reduced direct fees.

I receive standard commissions from trustees/insurers.

All commissions disclosed before engagement.

Best For:

Clients who prefer lower initial cash outlay and transparent commission disclosure

Either way:

Complete transparency. No surprises.

Detailed fee schedule provided during initial consultation based on your specific situation and asset complexity.

From First Conversation to Operational Foundation

The journey takes 3-6 months, depending on complexity.

Here's what to expect:

Discovery

Weeks 1-2

Initial consultation

Asset inventory

Goal mapping

Suitability assessment

01.

Architecture

Weeks 3-6

Foundation deed drafting

Beneficiary structure

Governance model

Tax strategy

02.

Specialist Coordination

Weeks 7-10

Trustee selection

Legal documentation

Tax opinion

PPLI structuring

03.

Implementation

Weeks 7-16

Liechtenstein registration

Asset transfer execution

Council establishment

Activation

04.

Ongoing Governance

Perpetual

First year: Quarterly review

Subsequent: Annual review

Compliance monitoring

Strategic adjustments

05.

This isn't a transaction—it's a multi-generational relationship.

About

Stephan Graf

Over 20 years in institutional asset management at LGT Capital Partners and Man Investments.

Now focused exclusively on Liechtenstein family foundation structuring for international families with CHF 1-5M+ in assets.

Based in Zürich, Switzerland.

Let's Discuss Your Situation

The journey begins with principles, not paperwork.

Our first conversation is a dedicated session to understand your family structure, wealth composition, and long-term vision—and to determine whether a Liechtenstein foundation makes sense for your specific situation.

No obligation. No pressure. Just an honest conversation about what's possible.

I respond to all inquiries within one business day.

Based in Zurich, Switzerland

Frequently Asked Questions

-

No. You design the foundation charter, define the beneficiaries, set the distribution rules, and can serve on the foundation council yourself. The foundation owns the assets legally, but you maintain economic control through the governance structure you create. Think of it as transferring legal title while retaining decision-making authority.

-

No. Asset transfers to the foundation are irrevocable—this is what creates the legal separation necessary for asset protection and tax benefits. You should only proceed if you're committed to the structure long-term. This permanence is a feature, not a bug—it's what makes the protection real.

-

Swiss family foundations are highly restricted—they can only be used for education, support in need, or helping family "establish themselves." They cannot fund general living expenses. Liechtenstein foundations have no such restrictions—they can provide comprehensive family support across generations. Additionally, Liechtenstein offers stronger asset protection, greater privacy (not in public register), and more flexible succession planning.

-

Distributions are defined in your foundation charter. Many clients structure regular distributions for living expenses or use liquidity loans—the foundation pledges assets as collateral for a personal loan, allowing you to access capital while keeping assets invested and growing. Your lifestyle doesn't change; the legal ownership does.

-

Proper structuring for Private Asset Structure (PAS) status is essential—the foundation must be truly "non-transparent" (you cannot retain excessive control like revocation rights). I design structures to meet Swiss tax requirements from day one. The initial transfer may trigger gift tax, but once PAS status is established, the foundation pays CHF 1,800 annually in Liechtenstein and you're only taxed on distributions you receive.

-

CHF 1-2M minimum, ideally CHF 2-5M+. Below CHF 1M, the setup costs (CHF 40-80k) and annual fees (CHF 15-30k+) are disproportionate to the benefits. Above CHF 2M, the wealth tax savings alone often justify the structure within 3-5 years, plus you gain asset protection and succession benefits.

-

Assets irrevocably transferred to the foundation before marriage or divorce proceedings are generally protected from marital division—they're no longer your personal property. However, timing is critical: transfers made during divorce proceedings or with intent to defraud a spouse can be challenged. Proper structuring with clean timing is essential. This requires legal advice specific to your situation.

-

Foundation structures cannot circumvent existing legal obligations. If you have known creditor claims, pending lawsuits, or divorce proceedings, those obligations typically survive the transfer. Asset protection works for future risks, not past liabilities. Full disclosure of your situation during consultation is essential.

-

Option 1: Fee-Only (Pure Independence)

You pay me CHF 20,000 directly for advisory services. I receive zero commissions from trustees, insurance providers, or banks. This model ensures complete independence—I have no financial incentive to recommend any particular provider.Option 2: Commission-Based (No Upfront Cost)

You pay no upfront advisory fee. Instead, I receive compensation from the trustees and insurance providers I coordinate (typically CHF 5-8k from setup fees and CHF 2-3k annually from ongoing trustee relationships). Total cost to you over 5 years is similar to Option 1—it's just structured differently. All compensation is fully disclosed before you proceed.Both models deliver the same quality of service and expertise. The choice depends on your preference for payment structure.

-

Typically 3-6 months from initial consultation to full activation:

Blueprint Design: 4-6 weeks

Implementation: 8-12 weeks

Activation: 2-4 weeks

Complex asset structures (multiple properties, operating businesses, international holdings) may take longer.

-

The foundation can make distributions to beneficiaries (which includes you, if named as beneficiary) at any time. Distributions are tax-efficient when structured properly. However, you cannot "dissolve" the foundation and take all assets back personally—that would defeat the protective structure. This is why the foundation should hold long-term wealth, not emergency funds.

→ Liquidity strategies are discussed during blueprint design